Given the repercussions of Section 24 of the Finance (No.2) Act 2015 on personally-owned properties[1], a growing number of investors are using Limited company buy-to-let mortgage to expand their portfolios. Although current capital costs are generally higher relative to individual purchases, competition amongst a wider pool of lenders may encourage better rates in the coming years (provided there are no macroeconomic circumstances that would force wholesale LIBOR and SWAP rates upwards).

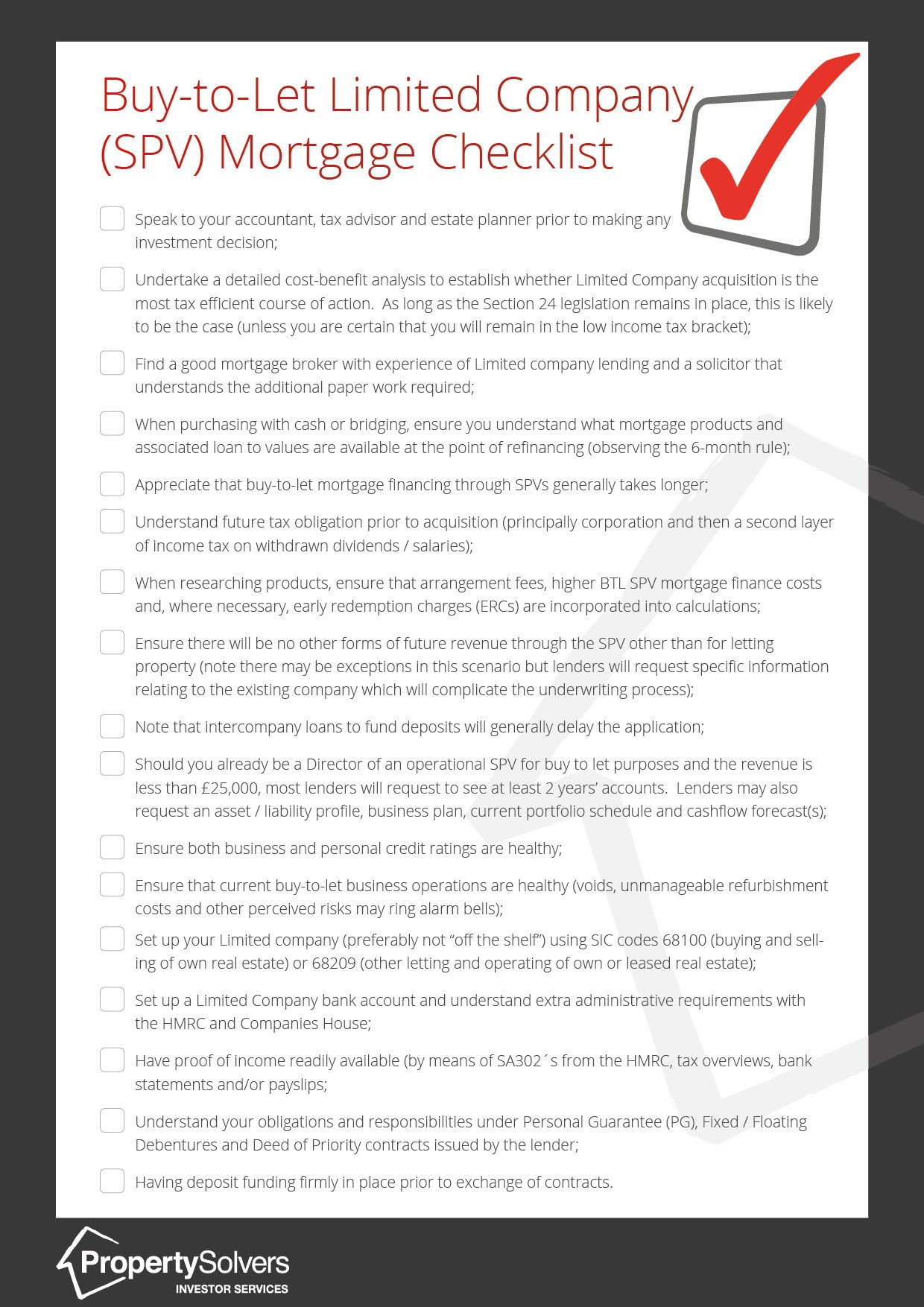

Checklist for Limited Company Buy-to-Let Property Purchases

Applying for a Limited company (Special Purpose Vehicle) mortgage is arguably more complex than even the stringent Prudential Regulation Authority (PRA) regulations for individually owned property purchases / non “like-for-like” remortgages[2].

Extracted from our professional property investors eBook, the checklist below aims to summarise some of the key points to run through during the initial stages of the Limited company purchase process.

Please click here for a printable PDF version of the buy-to-let Limited company mortgage checklist.

Building a “Corporatised” Buy-to-Let Portfolio

Although there is nothing stopping investors from approaching lenders directly, working with an experienced mortgage broker is usually recommendable. A good intermediary will find the best products suited to your own financial circumstances and the property in question. Many also have direct relationships with underwriters and, from time to time, exclusive access to attractive deals.

As the corporate buy-to-let lending sector is relatively embryonic, new application processes are reportedly slow (up to 8 weeks at the time of writing) – which will be of little use when purchases are time-constrained in auctions and other “fast sale” scenarios. In such situations, investors should position themselves to be able to transact quickly either through cash (vendors and professional sourcing companies would usually request proof of funds), some form of pre-existing and undrawn debt facility or reputable bridging finance. Most investors would then eventually refinance. Here, it should be observed that flash finance mechanisms can be costly, the 6-month[3] rule will normally apply and lenders are adopting a conservative approach to the “rinse and repeat” and “no money left in” models.

As mentioned previously, mortgages within Limited companies tend to be more expensive with 75% loan to value requirements largely being the norm (anything higher is likely to come with a number of associated conditions). As with individual buy-to-let mortgages, investors will also incur an arrangement fee and be subject to early redemption charges (ERCs). The costs of the more advanced form underwriting, however, are not necessarily passed on to the borrower. It is also widely believed that a process of natural competition will encourage more competitive products to appear in the marketplace in the coming years.

Preparing for a Buy-to-Let Property Purchase

To ensure there are no administrative hold ups, investors should have their company formally established with an associated bank account. Buy-to-let SPV lenders are reportedly tightening on income assessments and will typically require:

- at least 2-years worth of SA302s from the HMRC;

- tax overviews;

- a minimum 3 months worth of bank statements;

- if you are employed, your latest P60 and three of the most recent payslips.

Up-to-date detailed information on your existing property holdings will also be requested including:

- full address(es);

- value(s);

- outstanding mortgage(s);

- lender names;

- monthly payments;

- a rental income schedule.

We also suggest having portfolio, cashflow forecast and income + expenditure spreadsheets in addition to up-to-date tenancy agreements and a simple business plan which will outline your investment intentions and other key figures (you may want to use our buy-to-let financial calculator to assist you in this process). Note that some or all of these details will need to be validated.

Prior to the lender undertaking any background checks, it is also advisable to verify both your personal (consumer) and business credit scores with a reference agency such as Experian. Any mortgage application will be classified as a “hard search” and therefore leave a footprint on your credit file.

Moving forward, the ever rising using of technology within key financial processes is likely to mean that your creditworthiness as a buy-to-let mortgage borrower will be assessed on a more programmatic (as opposed to a “trust”) basis. Mortgage lenders are increasingly likely to adopt more sophisticated methods of analysing open market value, rental premiums and other key figures.

Ensure You Have the Correct Buy-to-Let Corporate Structure

From the outset, the lender will want to know that the corporate structure is set up for the sole purpose of holding property. A Limited Company SPV therefore must have limited activities. The SPV will normally be created recently and registered under one of the following Standard Industrial Classification of Economic Activities (SIC)[4] codes:

- Buying and selling of own real estate (68100); or

- Other letting and operating of own or leased real estate (68209)

Generally speaking, “off the shelf” Limited companies are not advisable – and it is always best to obtain the correct advice whilst ensuring that the company is clean (i.e. with no historical issues that could adversely affect any loan application). Should it be a requirement to distribute dividends to other family members legitimately in the future, investors must also be certain that the structure of the company is formed appropriately. For example, the standardised online forms may not have the right clauses specific to how investors would want to tax plan in the most efficient manner.

Should a borrower already be a Director of an operational SPV for buy-to-let purposes and the annual revenue is less than £25,000, most lenders will request to see at least 2 years’ accounts as well as personal income, expenditure and other related evidence. Note that it is only possible to alter the SIC code when filing the SPV´s Confirmation Statement (formerly referred to as the Annual Return) at Companies House. However, it is possible to file well in advance of the due date – meaning that the SIC code can be altered should it be fundamental to secure borrowing required.

Background checks will be undertaken on the individual applicant(s) and director(s). Any evidence that a landlord would not be able to realistically surmount any ongoing buy to let holding challenges such as voids, impending refurbishments and other perceived risks will usually result in a mortgage refusal.

Buy-to-Lenders Prefer Non-Trading Companies

The lender will want to see no signs of future revenue through the company of anything other than letting property and will normally also refuse mortgage finance should there be concerns over other trading activities. For instance, a branded lead generation / sourcing company or a Property Management Company (PMC) should generally not be used.

Some specialist lenders may not reject such applications – however investors should be mindful that there will typically be requests for further information (such as demonstrable solid net profits after dividend and salary withdrawals with no unexplained losses); funding limitations (higher downpayment requirements); personal guarantees / a fixed or floating charge debenture over the company to which they are lending (see below). Here, the application period will also take longer as further checks are carried out on the company in addition to the individual and the property itself.

Should the SPV have the correct SIC code but has previously traded in another field, lenders may be willing to move forward providing that the Directors can formally confirm that the company will be used for letting purposes exclusively.

Loans Between Buy-to-Let Limited Companies

Loans between companies are entirely possible, but will invariably add to the already complex nature of the underwriting process. For example, in a scenario where a borrower would like to use an inter-company loan from his/her trading business to fund part or all of the deposit, the lender will want to ensure that there are no unexplained losses and, once the funds are extracted from the trading company, the business will remain suitably robust and well-capitalised.

In addition to confirmation of a clean credit rating, any capital being injected into the transaction will need to be readily transferable.

Charges Against Limited Buy-to-Let Properties

Whilst the criteria will vary from lender to lender, investors should also be aware of the following requirements:

Personal Guarantee (PG)

In a situation of default and eventual repossession, the lender will normally “fire sell” the property (usually via an auction or receivership disposal) with the proceeds being used to settle underlying mortgage liabilities. Should there be any balance, the directors and shareholders offering the PG will be fully liable. In most circumstances, however, lenders will usually not take a charge on the investor´s main residence;

Debenture

Used to protect a lenders interest in a situation of default and eventual insolvency, this is a formal agreement that stipulates either fixed or floating charges alongside the terms and conditions. This document is then filed at Companies House. Note that Debentures are typically “all monies”, in other words – existing, present and future loan advances will be secured.

To note the difference between a fixed and floating charges:

Fixed Charge

A fixed charge is a “hold” on property meaning that the borrower cannot dispose without explicit permission from the lender that has control of the asset(s).

Floating Charge

A floating charge, in general terms, is a security on an asset that has an alterable quantity or value (such as cash, unfactored debt, raw materials, fixtures, fittings or other company resources used to generate business and trade). Within a buy-to-let lending framework, the borrower keeps control of the asset but in a repossession situation the floating charge effectively crystallises. SPV lenders are less likely to use these charges as they generally rank behind preferential creditors, prescribed-part creditors and salary distributions.

Finally, the lender will want to make sure that is well protect through a Deed of Priority.

Deed of Priority

An agreement that will be drawn up should there be one or more other lenders taking security over a SPV and will establish who will be “first in line” to recover any net proceeds in an insolvency scenario. The advance will be made against the security of a particular property and some lenders may agree to have recourse against the assets of an associated and/or parent company. However, most would normally prefer to operate exclusively on a “ring-fenced” basis within each SPV.

We would encourage you to download our professional property investors eBook goes into further depth on the topic of buy-let-purchasing using Limited Company. You will also receive our comprehensive buy-to-let financial calculator and exclusive access to direct-to-vendor (D2V) investment opportunities.

—

[1] For more on this topic, see our interview with Simon Misiewicz from Optimise Accountants: How Landlords Can Be More Tax Efficient Post Section 24 (Part 1) / How Landlords Can Be More Tax Efficient Post Section 24 (Part 2).

[2] Buy-to-let lenders do not want to create “mortgage prisoners”, therefore the PRA underwriting standards will not apply to borrowers looking to remortgage without any additional borrowing.

[3] The vast majority of lenders, bar certain circumstances, will not refinance a property within the first 6 months of the original purchase date. However, readers can consult the Council of Mortgage Lenders (CML) to understand where lenders may apply specific exemptions.

[4] Used to categorise business establishments by the type of economic activity in which they are engaged. The recommended SIC codes for buy to let SPV lending purposes – 68100 and 68209 – can be found under “Section L – Real estate activities” of the Condensed List on the Gov.uk website.