Although the enthusiasm surrounding blockchain technology has waned, the infrastructure behind bitcoin’s notable rise (and fall) in recent years still presents a compelling case to securely authenticate the exchange of valuable assets.

What is a Blockchain?

A blockchain essentially consists of records (“blocks”) that are inextricably linked and secured (into the “chain”) using cryptography[1]. These records exist via a distributed ledger[2] system that creates an open-source, decentralised mechanism for exchanging all types of information and transfers of value. The data on the blockchain is transparently validated by consensus (there are no intermediaries). This data, once stored, cannot be modified or deleted[3].

What is a Smart Contract?

A digital protocol that can verify, facilitate and enforce the performance of a contract regardless of its complexity. Using mathematically complex algorithms, all aspects of a contract can be made partly or fully self-executing when specific conditions are met[4]. No one party controls the contract, yet all parties can trust it. Arguably, therefore, smart contracts provide superior security levels relative to traditional contract law execution. Proponents also argue that costs are significantly reduced.

Archaic Property Conveyancing

Today, conveyancing is heavily fragmented, inefficient and involves archaic verification processes to assure legitimacy. From identity checks, fittings / contents / property information forms and deed history examinations through to surveys, mortgage confirmations / discharges, seller enquiries and contract drafting, few would deny that the entire process is a bureaucratic haze. Property title fraud alone costs the Land Registry approximately £10 million in indemnifying homeowners on an annual basis.

How Can Blockchain Be Used in the UK Property Industry?

The implementation of blockchain architecture means that the chronological stages of the conveyancing and property registration processes can occur within milliseconds.

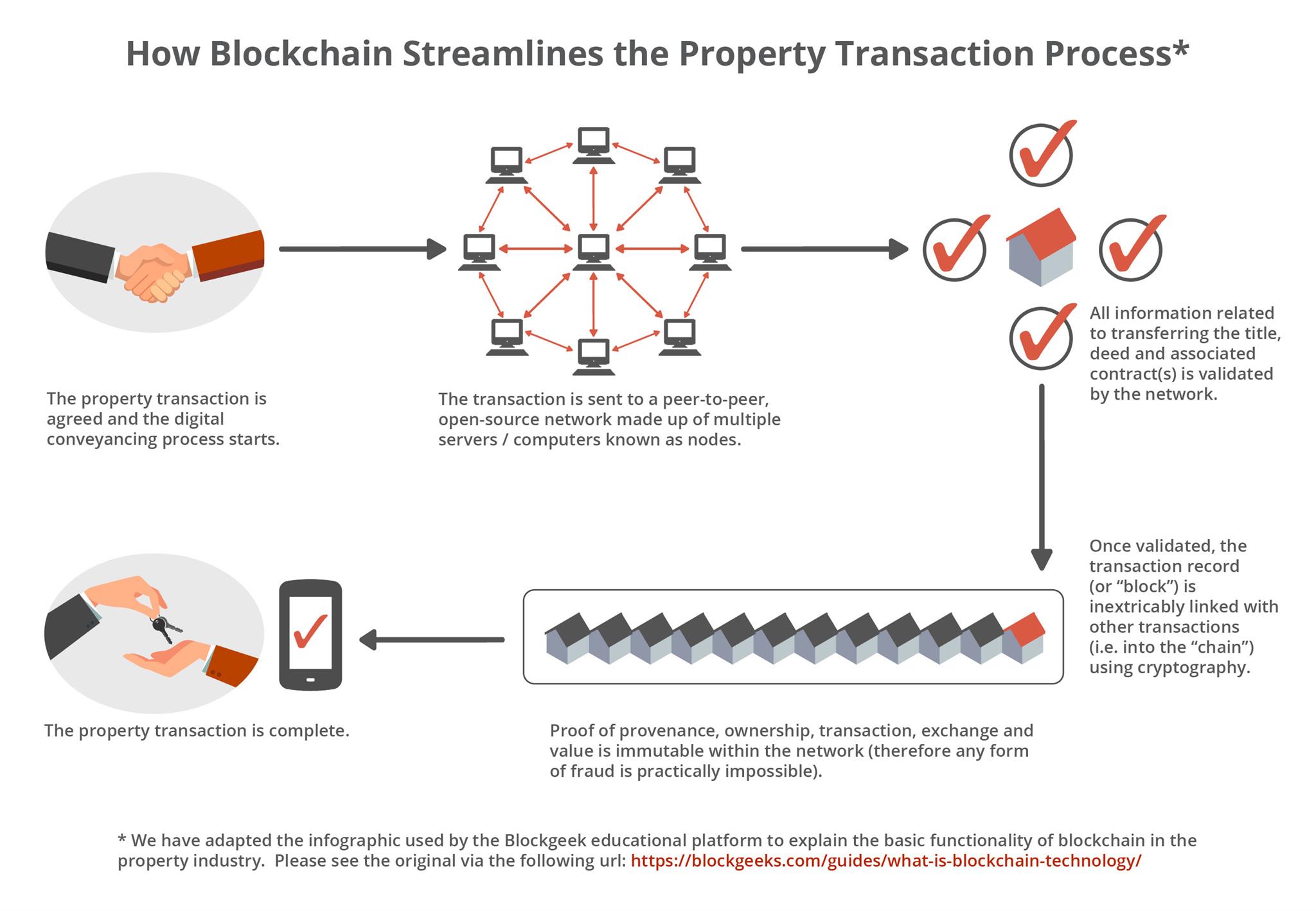

Referred to as “triple entry bookkeeping”[5], smart contracts written in software code effectively form part of a Decentralised Autonomous Organisation (DAO)[6]. Once a transaction is agreed, it is sent to a public ledger (or network) that operates on a peer-to-peer, open-sourced basis via multiple servers / computers known as nodes[7]. Each transaction within the network is characterised by a unique digital ID “block” after all information related to transferring the title, deed and associated contract(s) are validated. Once this process is complete, the data “blocks” are permanently placed onto the “chain” and the transaction is complete.

An unforgeable, time-stamped[8] digital signature is produced and the integrity of the transaction is guaranteed. This sequential process is undertaken without the need for third party or authoritative permissions.

In the property industry specifically, the blockchain functions as an immutable ledger where all deeds, mortgage information, property / land records and associated data are expedited much quicker and, upon the transaction’s conclusion, held perpetually[9].

Using Blockchain “Coloured Coins” in the Conveyancing Process

The blockchain title can be created in the form of a “coloured coin”, a non-fungible token that represents the underlying asset and contains mutually inclusive information such as the:

- Name of the current owner and future buyer (individuals in the transaction will be able to prove their identity without risks of forgery or impersonation);

- Legal description of the property;

- Mortgages, charges against the property and other relevant financial information;

- Restrictive covenants, negative easements, third-party consents etc.;

- Previous Anti-Money Laundering (AML) / Know Your Customer (KYC) checks.

This unique digital property data package[10] (analogous to a cloud-hosted wallet that replaces a paper deed / title) is fully secured and encrypted. Hashes[11] identify every transaction and the process does not require any manual intervention due to being pre-empted, self-authenticated, drafted using smart contractual stipulations and policed by the very nature of the cryptography. At the point of transfer, the seller would rehash (encrypt) the digital file to prove possession. This ensures that the passage of title between the seller (grantor) and buyer (grantee) is transparently executed. It is also possible to activate certain actions automatically, such as the instantaneous payment of stamp duty (integrating blockchain protocols into those at the HM Revenue and Customs[12]) and any sales fees due at completion).

The new owner is then identified using “public key cryptography”[13], analogous to a digital DNA. Proof of provenance, ownership, transaction, exchange and value can never be changed within the network. Therefore, by the impossibility of tampering with the cryptographically secure smart contract structure, even though fraudsters may digitally replicate the files, breaking the code would only occur when they have direct control of the keys and when all distributed copies of the ledger are hacked simultaneously (a practically impossible feat). Furthermore, proponents argue that digital “oracles” or specific application programming interfaces (APIs) can monitor the progress of each of the steps to ensure the enforceability and unbreakability of the contract.

In addition to massively reducing the routine administrative load, that are often susceptible to human error, these protocols also remove the need for title insurance and other preventative measures against fraud or other forms of cyber-crime. Legal auditing, to a certain degree, is also minimised and any contractual alterations can be recorded with negligible risk of future disputes.

As a further step, distributive file storage will also enable the synchronised transfer of intellectual property across the built environment including:

- Core attributes;

- Historical sales / transactional information, surveys, condition reports and other investigations;

- Architectural drawings, photography and other imagery;

- Surveys, valuations, inspections and other relevant condition reports;

- Integration with Building Information Modelling protocols (procurement, designs, previous planning applications)[14].

Blockchain’s Integration into the UK’s Land Registry and Planning Systems

Whilst not removing the well-recognised political ambiguity, blockchain offers much-needed efficiencies in the planning system. For example, sequential “tick box” (if/then) principles can form standardised meta processes – subsequently applicable to a range of key local planning authority decisions (without the need for administrative middlemen)[15].

As part of the 2017 Annual Report and Accounts, the HM Land Registry set out its vision for an “ambitious digital transformation towards becoming the world’s leading land registry for speed, simplicity and an open approach to data”. The objective is for “property to be changed instantaneously” and for the public database to hold more granular data through underlying blockchain protocols.

To test blockchain’s capabilities in the field of property transaction, a trial sale took place in 2019 in Gillingham, Kent – whereby a semi-detached property changed hands through the use of blockchain technology as a part of the “Digital Street” initiative.

With the demonstration itself taking less than ten minutes, the scope for remote connectivity was clearly revealed. The buyer was at work in Medway, Kent, the seller located in Gravesend, the buyer’s conveyancer in Manchester and the seller’s conveyancer in Central London.

Digital Street themselves were overseeing the transaction from Plymouth, with the digital ID verification and security specialists from Yoti and Shieldpay calling in from London and Malaga respectively.

This test, which utilised Corda – an open source blockchain platform developed by the R3 consortium, proved successful. This development represents evidence that, with more efficient data management, the transfer of land can run far more smoothly than before, cutting out middlemen by way of smart contracts, reducing delays and removing stumbling blocks.

The online “Sign Your Mortgage Deed” system, accessible to remortgaging homeowners via GOV.UK, is another recent development in the Land Registry / blockchain collaboration. Using the pre-existing GOV.UK Verify service for identity security and assurance, mortgage deeds can now be produced and signed as part of a largely disintermediated digital conveyance process legitimately recorded at the Land Registry.

As of February 2020, in excess of 7,000 mortgage deeds have been signed in this manner, with major lenders including Nationwide, HSBC, RBS, NatWest and Atom Bank utilising the service along with conveyancers such as LMS, Enact and Optima.

Of course, one major advantage of the Sign Your Mortgage Deed system has become apparent as the year 2020 has progressed. The digital signing of Land Registry documentation significantly reduces the need for face-to-face interaction between the parties involved.

This allows for social distancing and similar regulations to be effectively observed as the COVID-19 pandemic persists.

It’s worth noting that the general use of blockchain within real estate has altered in significance during the course of the global crisis, not only in that it reduces – or entirely negates – the need for in-person contact, but also because it speeds up the process and allows greater flexibility when it comes to transactions.

Additionally, the development of property “tokens” in connection with blockchain technology provides a more affordable alternative when it comes to property investment, reducing the risk and expense involved at a time when businesses and incomes are already in a fragile position.

Global Case Studies of Blockchain at Work in the Property Industry

Below are some interesting examples of the work already underway across various jurisdictions:

- In August 2017, Chicago’s Cook County Recorder of deeds concluded a successful 8-month pilot initiative transferring a property on to the blockchain, the conveyance of which was recorded into the public record using a coloured coin. Developed by Ragnar Lifthrasir – founder of velox.RE and the International Blockchain Real Estate Association (IBREA) – as the project met all the fundamental approval processes, the plan is now to perform blockchain conveyances across the 50 states[16]);

- Also in the US, StreetWire is leveraging blockchain technology to build the property data needed to support the adoption of smart electronic contract execution. The platform was borne out of CEO Oliver Tickner’s frustration when purchasing a Manhattan apartment. In April 2018, the organisation announced that they were developing a decentralized data network that will “provide global settlement services for real estate transactions”;

- BitProperty, a Japanese real estate Platform, uses smart contracts to fast-track the transaction process, apportion ownership rights and distribute dividends derived from income-producing property. The platform uses two types of token: one that represents the listed asset which generates income for shareholders (dependent upon the performance of the property). The other is backed by BitProperty manages assets and earns dividends from transaction fees in addition to profits generated from the company’s solar farm[17]. However, one perceived risk is that such tokens are not recognised as securities;

- As well as tokenised ownership, the Atlant platform is challenging Airbnb’s business model by offering a systemised peer-to-peer rental protocol using blockchain. With the history of every property owner and renter available on the secured network itself, both sides are protected and intermediary involvement is unnecessary;

- The Dubai Land Department (DLD) announced plans to become the first government body to fully adopt blockchain[18], with ambitious aims to digitally record and process all transactions using the technology by 2020. Developed by Emirates Real Estate Solutions (ERES), the government will partner with one of the region’s largest property developers wasl Asset Management Group, alongside the Emirates Identity Authority, the Dubai Electricity and Water Authority (DEWA) and Emirates NBD (the Emirate’s largest bank). In May 2019, it was announced that the DLD would partner with Dubai’s Mashreq Bank to “release a blockchain-based platform for recording and updating mortgage transactions”;

- In 2016, the Dutch foundation for real estate data StiVAD signed an agreement to work collaboratively with Kadaster (the national land registration agency) to formalise and implement a digitalised register for real estate transactions;

- In a market that has fallen by 70 percent since 2008, to attract secure and transparent investment into its property industry, the Ukrainian government has partnered with global blockchain infrastructure provider Bitfury Group. The technology is being used to auction seized assets and transfer state property and land registries to a blockchain platform;

- The Republic of Georgia is also working with the Bitfury Group to authenticate property related transfers. Over 100,000 digital documents have been recorded since February 2017;

- In 2016, a team of technologists from Ghana, Denmark and the US launched the Bitland initiative. The aim being to gradually introduce legitimate and digitally documented land titles across Africa;

- In Honduras, 80 percent of privately held land is untitled or unofficially so. Poor quality documentation means that entities can unilaterally change the context of deeds, often through manipulation and violence. Today, however, according to the Fundación Eléutera policy think tank, about one fifth of land records have been verified and digitised. Although there has been some political resistance, the adoption of a prototype blockchain-based land registry called Factom is gaining traction (see the full case study here);

- In 2017, Ubitquity, a SaaS[19] blockchain company, successfully piloted a platform with a Brazilian Real Estate Registry Office to securely record and track property deeds. As of the same year, Brazil’s Planning Ministry also began developing protocols with Microsoft and blockchain acceleration hub Consensys to govern identification and signature verification procedures. The Ministry uses an Ethereum-based self-sovereign identity[20] platform called UPort;

- In summer 2018, the Japanese government initiated trial property transactions in key cities using blockchain. The intention is to develop a new digital land registry that will cover the entire country by 2022;

- The Swedish government believes that blockchain could save taxpayers $100 million through implementation into its well-established land registry system (the Lantmäteriet). As of 2018, the Swedish land registry authority had reached the third phase of their “pilot”, which was marked by a live transaction demonstration using blockchain; [21]

- Silicon Valley proptech company Propy reported a successful trial to implement the use of blockchain for land registry purposes – again in 2018. The trial followed a six week study of the blockchain registry system;

- Another development seen in 2018 was the announcement made by the Netherlands Land Registry that it too will be running tests to determine the potential of blockchain usage within its processes, along with the possible inclusion of AI;

- A Parisian villa became the first European property to be sold via blockchain in June 2019, to buyers Sapeb Immobilier and Valorcim – two French real estate agencies. The process was overseen by blockchain investment platform Equisafe and powered by Ethereum, with the property valued at €6.5 million. Ownership was first transferred to SAPEB AnnA, a joint stock company, then divided into 100 tokens – each of which could be further separated into 100,000 shares;

- In February of 2020, the EU – along with Liechtenstein and Norway – saw the start of the gradual launch of the European Blockchain Services Infrastructure (EBSI). This network has been implemented in order to create a Digital Single Market throughout the territory;

- In 2020, a partnership was formed between German real estate company Tigris Immobilien GmbH and Europe-wide tokenization specialists Black Manta Capital Partners. The purpose of this collaboration was to enable investors to purchase tokens related to high-end properties in Berlin. With a minimum investment of $500, this enterprise has an air of accessibility. Black Manta Capital Partners plans to carry out similar projects in the near future;

- UK-based development company Brikcoin is also planning an exciting enterprise through the application of blockchain technology. The company intends to introduce a “revolutionary investment model”, which will aid in the development of sustainable affordable housing through the development of the company’s own “Brikcoin” tokens – 60% of which will be offered to the public at nominal prices in order to raise £5.33 million for the project;

- The Global Property Register, first conceptualised in 2016, has been making progress towards its goal of building the first worldwide real estate register on the blockchain. Between October 2019 and October 2020, the organisation has outlined plans to cover the USA, UK, Nigeria, Brazil, India, South Africa and Pakistan;

- Since 2017, the world has seen the development of influential and impactful new startups focussing on blockchain and real estate, including International organisation Ledger Leopard, US-based Harbor, ShelterZoom, Imbrex and CryptoProperties, Slovenian BlockSquare, Russian Atlant and Italian BrikBit. The field is booming with new players and technological advances, suggesting that blockchain technology really is the way forward for real estate.

It would seem the likelihood of blockchain becoming an integral part of real estate business plans is growing by the day.

Conclusions (The Challenges of Bringing Blockchain into the Property Industry)

It would be premature to conclusively define blockchain’s role in the property. However, as the research and experimentation continue, the embryonic technology clearly has an important role to play moving forward. Administrative time and cost savings, a more transparent due diligence process, fewer incidences of title fraud and other risks that often jeopardise the security of sale will all appeal to investors and developers alike. As seen above, the application of the technology across the fast-growing peer-to-peer business models is also particularly interesting.

Playing devil’s advocate, it is worth highlighting that although technologies such as Artificial Intelligence will work complementarily with blockchain protocols, a perfectly executed digital conveyance can still be scuppered by credit, survey and other financing requirements.

Mainstream take-up of the technology will also demand a huge amount of computer processing power and energy use. As a result, although the associated costs may well reduce with scalability, fully operational blockchain registries and models will take time to build. For instance, for every country there will be a massive challenge to accurately and securely transfer all land registry data into the blockchain.

The technology offers no recourse for the unreliability of the data contained within it. Therefore, should erroneous transaction information be inputted from the outset, the network will still confirm its authenticity and accept any future exchanges provided the correct protocols are adhered to. This latter issue could be particularly problematic in non-advanced economies where corruption is endemic, and deeds are scattered across different areas of jurisdiction. This would, therefore, be the responsibility of governments to develop legally-compliant systems that agree what information can and cannot be entered into the blockchain.

Lawyers reading this may also wonder how they will be affected. The speed and efficiency of the indelibly legally binding smart contracts may render the more administrative aspects of the profession obsolete. Should blockchain gain the traction that its proponents imagine, there is an argument that the lawyers of the future would perhaps take on more of a supervisory role – monitoring compliance, analysing intellectually demanding points of law, dealing with the more face-to-face side of the conveyancing process for example.

Inevitably, legal structures will also need to adapt particularly around questions of data protection and security. In the UK, beyond compliance with anti-money laundering regulations, today there are very few government regulations and laws surrounding the use of blockchain. Bodies such as the Law Society and the Financial Conduct Authority will have to ascertain how blockchain transactions are monitored. The FCA is adopting a “wait and see” approach, although has reportedly been communicating with regulators in other jurisdictions[22].

This post has merely touched on a topic that looks set to gain significant traction and debate in the coming years. As blockchain inevitably continues to mature, it will certainly be interesting to watch how its adoption into the property industry takes shape.

—

[1] Cryptography can be defined as the science and application of protecting information by transforming it into formats unrecognisable to unauthorised users.

[2] Digital data that is replicated, synchronised and consensually shared across a large network.

[3] For excellent explanations of blockchain over-arching principles, see Coindesk’s What is Blockchain Technology?, Hackernoon’s WTF is The Blockchain?, Blockgeek’s What is Blockchain Technology?, a BBC Newsnight Report on Blockchain, Nick Szabo’s Money, Blockchain and Social Scalability, Practical Law’s Blockchain Technology: Emerging from the Shadows and Bettina Warburg’s TED talk on How the Blockchain will Radically Transform the Economy. An article entitled: What is Ethereum? Everything You Need to Know About Ethereum, Explained also contains interesting insights.

[4] A useful analogy used by The Spectator magazine was as a “giant public spreadsheet” where all parties in a transaction can see what is happening and make changes based on actions they have taken or transactions they have completed. Once certain cells in the spreadsheet are filled, a contract is automatically generated.

[5] An enhancement to the traditional double-entry bookkeeping concept, whereby any entry into a transactional record is additionally and cryptographically sealed by a third party.

[6] See this useful explanatory YouTube video as well as this article via Blockgeeks which provides a solid explanation of Ethereum, the technology that enables developers to build and deploy applications such Decentralised Autonomous Organisations.

[7] The number of nodes within a blockchain network can be anything from the hundreds to the tens of thousands.

[8] Monitoring the creation and future modification times of a document.

[9] Key points of a property transaction’s history can be accurately “replayed” meaning that the chain of ownership is uninterrupted by external factors.

[10] Some industry specialists are referring to property titles as “unique ownership certificates”

[11] Each transaction (block) is encoded and sent to all the network in the form of a long string of characters in the form of a hash. For the transaction to be valid, the first character set of the new hash needs to be the same as the last character of the preceding hash. The network must verify the validity of the block (transaction record) for it to be added to the chain.

[12] See the PwC report: How blockchain technology could improve the tax system.

[13] A set of characters based on complex mathematics.

[14] See this article by Dave Hughes, construction consultant: The impact of blockchain technology on the construction industry.

[15] See this article by Ronan O’Boyle of Urban Intelligence: Block capital – How blockchain could change planning.

[16] See a full synopsis of the Velox.RE process here, an interview with Ragnar Lifthrasir at the RealComm Conference here and another EG Techtalk Podcast interview with him here;

[17] See the company’s whitepaper: BitProperty: A Platform for Tradeable and Liquid Real Estate.

[18] The government media office announced in September 2017 that: “DLD has created the blockchain system using a smart and secure database that records all real estate contracts, including lease registrations, and links them with the Dubai Electricity & water Authority (DEWA), the telecommunications system and various property related bills. Blockchain’s secure, electronic real estate platform incorporates personal tenant databases, including Emirates Identity Cards and the validity of residency visas, and allows tenants to make payments electronically without the need to write cheques or print any papers. The entire process can be completed electronically within a few minutes at any time and from anywhere in the world, removing the need to visit any government entity.”

[19] Software as a Service

[20] The storage of personal and business identity data on devices that can be used across daily transactions (for claims, proofs and attestations) without relying on central databases.

[21] See an interesting report on using blockchain as a technical solution for real estate transaction here.

[22] In January 2016 the Government Office for Science published Distributed Ledger Technology: Beyond Blockchain which set out the benefits of using the technology and recommends widespread integration.